Title: Exploring the Prospects and Strategies in the Technology Stock Market

Exploring the Prospects and Strategies in the Technology Stock Market

Technology stocks have long been an area of keen interest for investors seeking growth opportunities and innovationdriven returns. As the tech sector continues to evolve and shape the global economy, understanding its dynamics and crafting effective investment strategies becomes paramount. In this comprehensive guide, we delve into the intricacies of the technology stock market, analyzing its current landscape, identifying key trends, and offering strategic insights for investors.

The technology stock market encompasses a diverse range of companies involved in the development, manufacturing, and distribution of technologyrelated products and services. This includes software firms, hardware manufacturers, semiconductor companies, internet giants, and emerging tech startups.

Key Trends Shaping the Technology Sector

1.

Artificial Intelligence (AI) and Machine Learning

: AI and machine learning technologies are revolutionizing industries, driving efficiency, and innovation across various sectors.

2.

Cloud Computing

: The shift towards cloudbased services continues to accelerate, with companies embracing cloud infrastructure for scalability, flexibility, and costeffectiveness.

3.

5G Technology

: The rollout of 5G networks presents significant opportunities for tech companies, enabling faster connectivity, enhanced IoT capabilities, and new applications.

4.

Ecommerce and Digital Transformation

: The pandemic has accelerated the digital transformation, with ecommerce, digital payments, and online services witnessing unprecedented growth.

1.

Diversification

: While technology stocks offer high growth potential, they also come with increased volatility. Diversifying your portfolio across different subsectors and market caps can help mitigate risks.

2.

Focus on Fundamentals

: Despite the allure of disruptive technologies, investors should prioritize companies with strong fundamentals, including robust revenue growth, competitive moats, and sustainable business models.

3.

LongTerm Perspective

: Investing in technology stocks requires a longterm perspective, as trends may take years to materialize. Avoid succumbing to shortterm market fluctuations and focus on the underlying value of the companies.

4.

Stay Informed

: Keep abreast of technological advancements, industry trends, and regulatory developments that could impact the performance of tech stocks. Continuous learning and research are essential for making informed investment decisions.

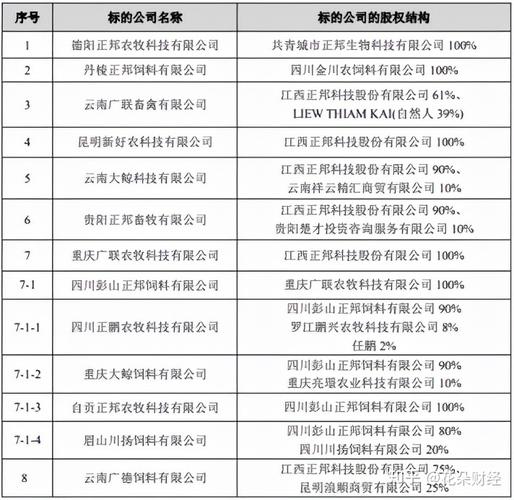

As one of the leading technology companies, "正帮科技股" (ZB Tech) commands a significant presence in the global tech market. Let's examine some factors contributing to its positive prospects:

1.

Innovative Product Portfolio

: ZB Tech boasts a diverse portfolio of innovative products and services, ranging from cuttingedge software solutions to advanced hardware devices.

2.

Strong Financial Performance

: The company has demonstrated robust financial performance, with steady revenue growth, healthy profit margins, and prudent cost management.

3.

Market Leadership

: ZB Tech holds a dominant position in key market segments, leveraging its technological expertise and brand reputation to outpace competitors.

4.

Global Expansion

: With a focus on international expansion, ZB Tech is tapping into new markets and forging strategic partnerships to drive growth and market penetration.

The technology stock market offers exciting opportunities for investors seeking growth and innovationdriven returns. By understanding key trends, adopting strategic investment approaches, and staying informed, investors can navigate the dynamic landscape of the tech sector effectively. Companies like "正帮科技股" exemplify the potential for success in this everevolving industry, making them attractive investment prospects for those bullish on technology.